There may be some bug on the Venmo app that is causing the transactions to fail. Sometimes, users forget to upgrade the app to the latest build, and incompatibility issues may arise. If bank servers are going through downtime or have any major issues, then money won’t be debited from your account connected to Venmo. It results in a declined transaction and an eventual payment failure.

More Reasons for Venmo Transaction Declined or Payment Failed Error

Venmo’s algorithm can deem inactive accounts suddenly performing several high-ticket transactions suspicious. This can lead to transactions getting declined. Also, there is a cap on weekly peer-to-peer payments and payments done by customers with identity verification. Exceeding that limit will cause the transitions to decline. If you are a spender who doesn’t keep a tab of what you have been spending, you may end up having insufficient balance in your bank account. Without having sufficient money, you cannot make payments. Problematic and slow internet connections can hamper transactions as well. If the credit/debit card you have connected to Venmo has expired, then no transaction will take place.

Ways to Fix Venmo Transaction Failed Error on Android and iOS

These days most people use their smartphones to make digital payments and bank transfers. So, depending on whichever operating system you use, Android or iOS, you can follow these troubleshooting tips to fix the declined transaction issue on Venmo.

1. Update Venmo App

Here are the steps to update the Venmo app to a newer version on your Android and iPhone.

Android

iOS

2. Use a WiFi Network Instead of Mobile Data While Using Venmo

Mobile data is often slow as compared to a stable WiFi network. So, make sure your Android or iOS device is connected to a WiFi network. Usually, when a payment declines, the money doesn’t get debited from your account. Even if it gets debited and doesn’t get credited to the payee’s account, the amount gets rolled back to your account. You can connect your device to a WiFi network and retry the payment. Otherwise, you can toggle between flight modes on your Android/iOS phones to fix network issues.

3. Pay Using Other Payment Methods

In today’s digital era, there are a lot of alternatives for digital payments which you can easily use from your smartphone. If the payment on Venmo is getting declined, then use other prominent digital payment apps such as Google Pay, Square, or PayPal.

You may perform a direct transaction from your bank account to the recipient’s bank account. While it may sound funny but pay in cash if possible. If it is a smaller transaction and the business accepts cash, then a cash payment would get your job done.

4. Check if Your Bank Card Has Expired

A credit or debit card has an expiry date that is mentioned on the card. You need to check and ensure that the concerned card you want to use has not expired yet. The expiry date for any credit/debit card is mentioned in MM/YY format.

For example, if the credit card expiry date is mentioned as 9/24, this means the expiry date is September 2024. Once the month is complete, the card will stop functioning. If you find out that the card has expired, then reach out to your bank and follow the necessary instructions to apply for a new card. Once your new bank card is ready, you can connect the new card with Venmo and start making transactions using it. To connect a new credit or debit card to Venmo, follow the steps below.

5. Update Your Account Information on Venmo

To make account management simple on Venmo, follow the steps I have mentioned below. Without verifications, any transaction you proceed with will be promptly declined by Venmo. Also, while adding your bank details to Venmo, ensure that you are entering the correct name you have submitted to your bank, the correct bank account number, and banking codes.

If you have an account created in a new bank and you want to use that on Venmo, then update the information accordingly on Venmo. Remove the older bank account and integrate the new one.

6. Avoid Successive High-Volume Transactions on Venmo

If you are not frequently using Venmo and suddenly using it to make high-volume transactions, the platform may flag it as suspicious. That will lead to the account getting frozen or the transaction getting declined. If at all you have to make frequent transactions of higher denominations, make them through different platforms instead of relying on only Venmo.

7. Check if You Have Surpassed the Weekly Transaction Limit

Weekly there is a limit of $299.99 for peer-to-peer payments. On the other hand, users with their identity completely verified on Venmo are eligible to perform a transaction of up to $60,000 a week. Anything above this limit is not allowed on Venmo. Check your transaction history on Venmo to see your transactions throughout the week. If you have surpassed the limit mentioned above, then you need to wait for the next week to initiate more transactions. In case of an emergency use other forms of payment.

8. Have Sufficient Funds in Your Bank Account

Use your bank’s app to check the available balance in your account. If you are short of funds, then credit a substantial amount in your bank account. Then you can use Venmo to make digital transactions without any hassle.

9. Avoid Transactions Related to High-Risk Businesses

Venmo considers a few businesses as high-risk, which are prone to financial fraud or card chargebacks. If you are performing transactions related to these businesses, then there is a chance of payment failure or transaction decline.

Businesses such as adult website transactions, transactions dealing with alcohol or substance purchases, firearms, dating services, gambling, and credit repair services come under high-risk businesses, as per Venmo. Find alternate ways to make your payments without using Venmo to avoid a decline of transactions or payment failure.

10. Contact Your Bank Support Team

If there is any issue at the bank’s end, you can contact them to know about that. If the bank is carrying out maintenance, then all accounts and cards connected to those accounts won’t be able to perform a transaction until the servers are reinstated.

These days each bank has its official apps meant for Android and iOS. Install the apps on your respective phones and use the designated customer support options to reach out to your bank.

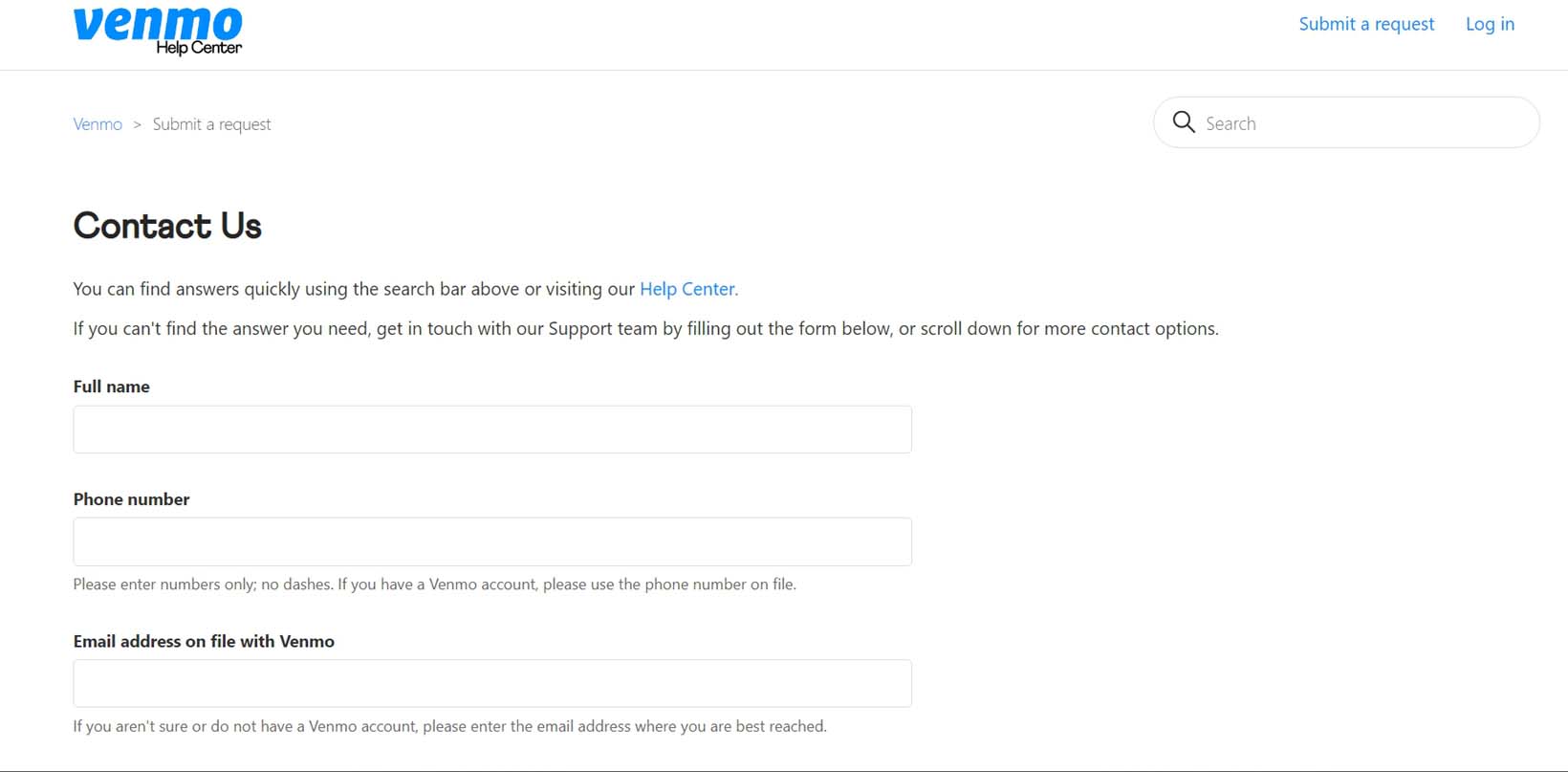

11. Get Help from Venmo Customer Support

If other troubleshooting tips mentioned earlier did not help you in fixing the transaction declined and payment failed error on Venmo, contact the official customer support of Venmo. You can fill up the Contact Form and submit it citing your issues in detail.

You may also consider giving them a phone call at (855) 812-4430. This telephonic support is available from 8:00 AM to 8:00 PM CT, seven days a week. You can use the Venmo app for Android and iOS to connect to customer service.

Conclusion

I hope now you know how to fix Venmo Transaction Declined and Payment Failed Error on your Android and iOS devices. Digital payment is very useful, and Venmo is a prominent platform offering the service. To use its features smoothly, troubleshoot all the issues right away. If you’ve any thoughts on Fix Venmo: Transaction Declined or Payment Failed Error, then feel free to drop in below comment box. Also, please subscribe to our DigitBin YouTube channel for videos tutorials. Cheers!